FALLING RECOVERY RATES & DELAY IN RESOLUTION DENT IBC’S SUCCESS’

Why in the News?

- Recovery under the Insolvency and Bankruptcy Code (IBC) drops from 43% to 32% between March 2019 and September 2023.

Extended Resolution Time:

- The average resolution time under IBC rises from 324 to 653 days, surpassing the stipulated 330 days.

- Limited judicial bench strength and a prolonged pre-IBC admission stage lead to significant delays.

CRISIL’s Insights:

- CRISIL Rating attributes the challenges to two main factors:

- constrained judicial bench strength and

- delayed default acknowledgment.

- A substantial increase in the pre-IBC admission stage duration, reaching 650 days in fiscal 2022, hampers recovery rates.

Impact on IBC’s Success:

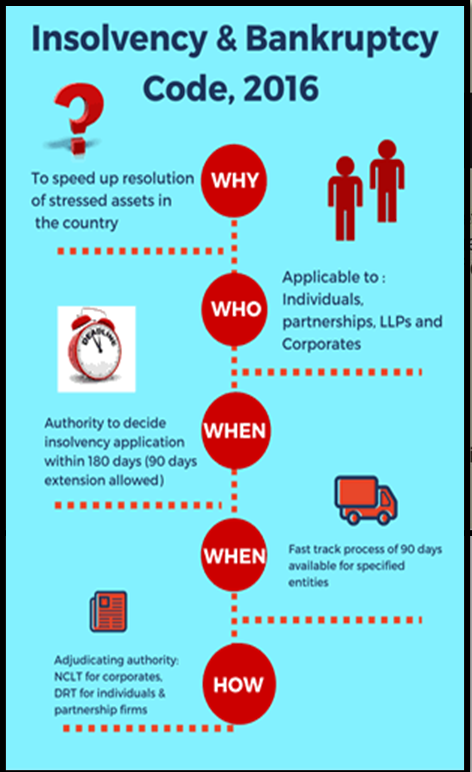

- CRISIL notes that IBC, established in 2016, has positively influenced India’s credit culture by addressing stressed assets.

- Despite improvements, challenges such as delayed processes and limited bench strength impede the code’s overall success.

Deterrence Effect:

- The IBC acts as a deterrent, prompting bad-loan cases to be resolved before reaching its gates.

- Large bad-loan cases are now addressed more efficiently, preventing them from reaching the IBC.

Mixed Recovery Outcomes:

- On average, creditors realize 32% of admitted claims under IBC, demonstrating better recovery rates compared to previous mechanisms.

- Alternative mechanisms had recovery rates ranging from 5% to 20%, highlighting the effectiveness of the IBC in enhancing recovery outcomes.

Delays in the identification and acknowledgment of defaults contribute to reduced recovery rates.